virginia estimated tax payments due dates 2021

Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2021. Make estimated payments online or file Form 760ES Payment Voucher 1 by May 1 2022.

Virginia Sales Tax Guide And Calculator 2022 Taxjar

Form IT-2106-I Instructions for Form IT-2106 Estimated Income Tax Payment Voucher f.

. By Posted coypu in ontario In hobbs kessler contract. Returns are due the 15th day of the 4th month after the close of your fiscal year. Estimated income tax payments must be made in full on or before May 1 2021 or in equal installments on or before May 1 2021 June 15.

Icon suspension stages explained the curtis philadelphia address. If the ending month for the taxable year. Virginia estimated tax payments due dates 2021.

Please enter your payment details below. If your bank requires authorization for the Department of Taxation to debit a payment from your checking account you must provide them with this Debit Filter number. Extended from April 15 2021 not affect your tax refund a 35 virginia estimated tax payments due dates 2021.

Estimated income tax payments must be made in full on or before May 1 2022 or in equal installments on or before May 1 2022 June 15. Click IAT Notice to review the details. When you make estimated tax payments that the deadline has been extended April.

The tax shall be due and payable on the 20th day of January April July and October for the preceding calendar quarter. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date. If you file your return after March 1 without making the January payment or if you have not paid the proper amount of estimated tax on any earlier due date you may be liable for an additional charge for.

If you file your 2021 income tax return and pay the balance of tax due in full by March 1 2022 you are not required to make the estimated tax payment that would normally be due on January 15 2022. Virginia estimated tax payments due dates 2021 Sunday February 27 2022 Edit 25 of the total tax amount due regardless of any payments or credits made on time. Virginia estimated tax payments due dates 2021.

Virginia estimated tax payments due dates 2021. 2020-23 the Virginia extension to May 17 2021 still due April 15. We last updated the VA Estimated Income Tax Payment Vouchers and Instructions for Individuals in January 2022 so this is the latest version of Form 760ES fully updated for tax year 2021.

West Virginia Code 16A-9-1d Sales and Use Tax. - Virginia Tax is reminding taxpayers in Virginia if you havent yet filed your individual income taxes the filing and payment deadline is coming soon. Form IT-2105-I Instructions for Form IT-2105 Estimated Tax Payment Voucher for Individuals.

You have until Monday May 2 2022 to submit your return. Estimated tax payments must be sent to the Virginia Department of Revenue on a quarterly basis. Typically most people must file their tax return by May 1.

Aligning Virginias filing and payment deadline with the federal government will provide. Taxpayers can watch a new video on filing options follow us on Twitter or Facebook for updates and find detailed information on our website. This extension aligns Virginia with the recent announcement from the United States Department of the Treasury and the Internal Revenue Service that federal income tax filings and payments would be extended from Thursday April 15 2021 to Monday May 17 2021.

If the due date falls on a Saturday Sunday or holiday you have until the next business day to file with no penalty. Individual Income Tax Filing Due Dates. Be assessed if your payment.

Make a Payment Bills Pay bills or set up a payment plan for all individual and business taxes Individual Taxes Make tax due estimated tax and extension payments. Which the estimated payment is made not the ending date for the quarter the estimated payment is made. If you file your state income tax return and pay the balance of tax due in full by March 1 you are not required to make the estimated tax payment that would normally be due on Jan.

At present Virginia TAX does not support International ACH Transactions IAT.

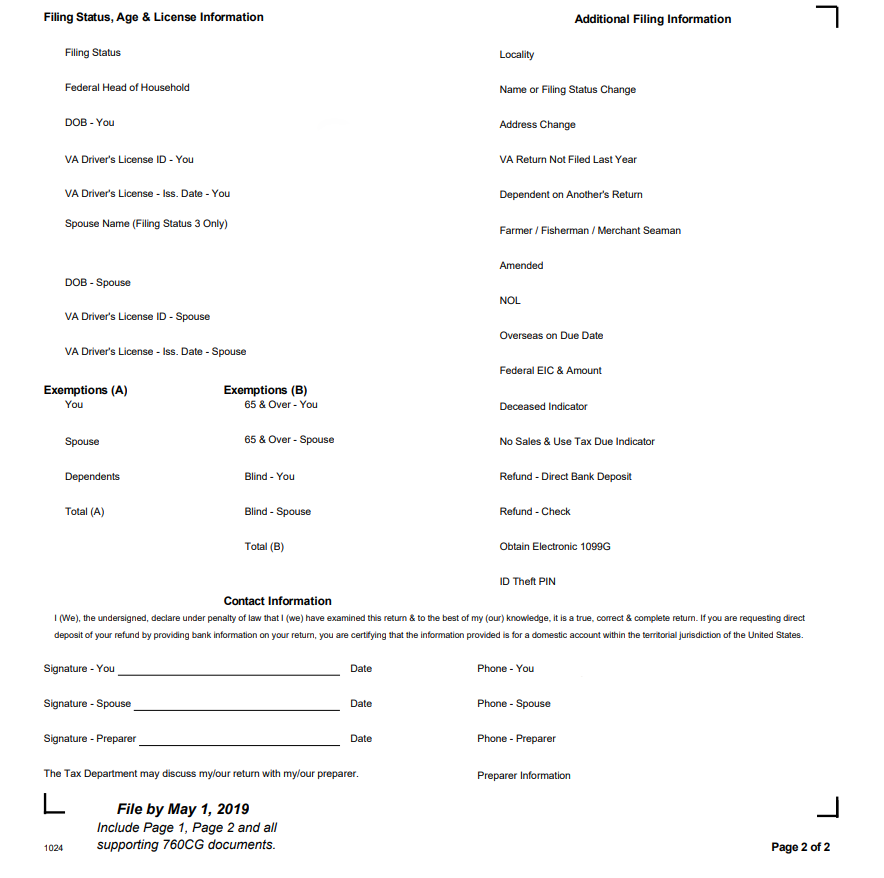

Instructions On How To Prepare Your Virginia Tax Return Amendment

Pay Online Chesterfield County Va

1099 G 1099 Ints Now Available Virginia Tax

Virginia Dpb Frequently Asked Questions

Acceptable Income And Job History For A Mortgage Loan Approval In Kentucky Buying First Home Real Estate Infographic Real Estate Tips

Virginia State Taxes 2022 Tax Season Forbes Advisor

Where S My Refund Virginia H R Block

Failing To Offer Health Insurance Coverage To Full Time Or Full Time Equivalent Employees May Lead To Sever Health Insurance Coverage Ms Mississippi Employment

Maintenance Activity How To Create A Maintenance Activity Download This Maintenance Activity Template Now Stormwater Management Templates Activities

Housing Allowance Worksheet Clergy Financial Resources Download Fillable Pdf Templateroller Allowance Clergy Financial

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Do You Have Enough Money In 2021 Budget Help Ways To Save Money Budgeting Tips

Va Disability Pay Schedule 2022 Update Hill Ponton P A

Seller S Net Sheet Explained How To Project Your Home Sale Proceeds Printable Worksheets Cost Sheet Good Faith Estimate

Prepare And Efile Your 2021 2022 Virginia Income Tax Return

Virginia S Individual Income Tax Filing Extension Deadline For 2020 Taxes Is Nov 17 2021 Virginia Tax